36+ Charitable Remainder Trust Calculator

Your average tax rate is 1198 and your marginal tax rate is 22. A philanthropic charitable organization is a nonprofit organization organized and operated to benefit the public.

Charitable Remainder Trust Calculator Crt Calculator

The outcomes could determine which party controls the US House of Representatives.

. FA vs Bank CD. Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc. Introduce your students to curriculum-linked.

Gift loans to a charitable organization contributions to which are deductible if the total outstanding amount of loans between the. Exhibitionist Voyeur 052517. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021.

For the same reason that Social Security benefits will receive a 87 boost as a cost-of-living adjustment for 2023 I Bonds have been. Exhibitionist Voyeur 052117. Section 179 deduction dollar limits.

6 to 30 characters long. Molly learns who she can trust the hard way. Jim completes his 2022 QCD worksheet by entering the amount of the remainder of the aggregate amount of the contributions he deducted in 2020 and 2021 4000 on line 1.

If you make 70000 a year living in the region of Oregon USA you will be taxed 15088. 1026 Philanthropic Charitable Organization. Prop 30 is supported by a coalition including CalFire Firefighters the American Lung Association environmental organizations electrical workers and businesses that want to improve Californias air quality by fighting and preventing wildfires and reducing air pollution from vehicles.

To advance religion education or science. Under Final Regulations - TD9918 each excess deduction on termination of an estate or trust retains its separate character as an amount allowed in arriving at adjusted gross income a non-miscellaneous itemized deduction or a miscellaneous itemized deductionFor more information see the Instructions for Form 1041. Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off.

Pension trust must be allocated between 1 contributions which are Puerto Rico source income. To erect or maintain public buildings. Dont include this amount on line 4 below.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Democrats hold an overall edge across the states competitive districts. Enter cash contributions that you elect to treat as qualified contributions plus cash contributions payable for relief efforts in qualified disaster areas that you elected to treat as qualified contributions.

And 2 investment earnings which are US. Orpheus in the Underworld is a comic opera composed by Jacques Offenbach with a French-language libretto by Hector Crémieux and Ludovic HalévyIt was first performed as a two-act opéra bouffon at the Théâtre des Bouffes-Parisiens Paris in 1858 and was extensively revised and expanded in a four-act opéra féerie version presented at the Théâtre de la Gaîté in 1874. Key findings include.

ASCII characters only characters found on a standard US keyboard. Private Tutor 465 Molly teaches the Teacher. Microsoft describes the CMAs concerns as misplaced and says that.

The account earns 20 interest. Enter your other charitable contributions made during the year. Examples include those that are organized to relieve the poor distressed or underprivileged.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. If no other interest is credited to your account during the year the Form 1099-INT you receive will show 35 interest for the year. November 25 1835 August 11 1919 was a Scottish American industrialist and philanthropistCarnegie led the expansion of the American steel industry in the late 19th century and became one of the richest Americans in history.

Four in ten likely voters are. K ɑːr ˈ n ɛ ɡ i kar-NEG-ee. A motorcycle loan calculator that allows one to enter data for a new or existing motorcycle loan to determine ones payment.

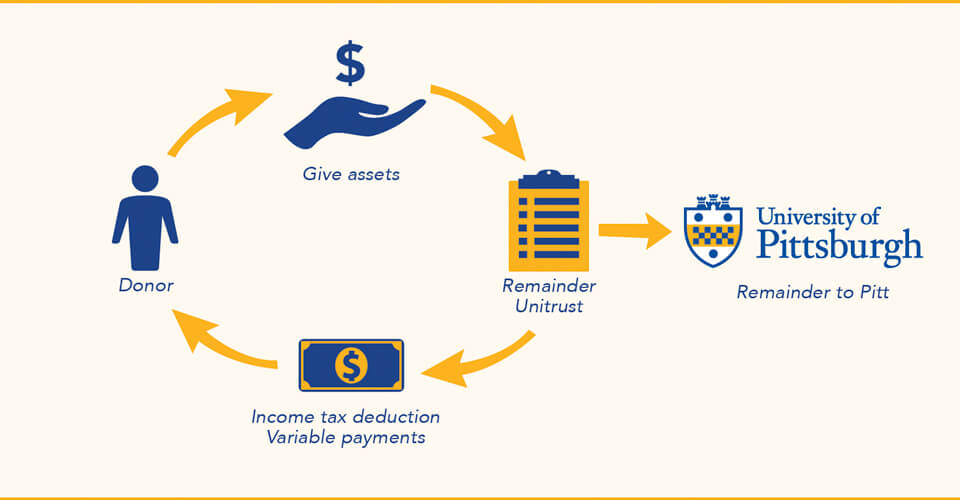

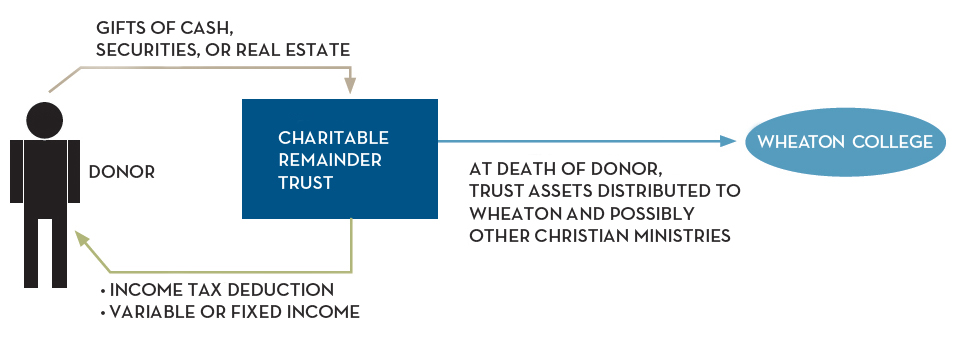

Charitable Remainder Trust. You also receive a 15 calculator. Excess deductions on termination.

Senior officials that the CIAs Counterterrorism Center had determined that Osama Bin Laden and al-Qaeda were responsible for the September 11 attacks. This is effected under Palestinian ownership and in accordance with the best European and international standards. Governments measure of inflation the CPI-U which has been rather high throughout 2022.

Robb Variable Corp which are SEC registered broker-dealers members FINRA SIPC and a licensed insurance agency. NW IR-6526 Washington DC 20224. Our resources have been designed to give you a wide understanding of what it takes to run an internationally successful business whilst helping to develop core employability skills and explore work opportunities beyond the school gates.

Proposition 30 on reducing greenhouse gas emissions has lost ground in the past month with support among likely voters now falling short of a majority. Explore our free curriculum-linked resources for students aged 14 Students. One can enter an extra payment and a rate of depreciation as well to see how a motorcycles value may decrease.

Must contain at least 4 different symbols. Distributions from the US. This amount is figured on his 2021 QCD worksheet and is entered on line 1 of his 2022 QCD worksheet.

He became a leading philanthropist in the United States Great Britain. Why Youre Hearing So Much About I Bonds. Pension trust of your employer.

These bonds are not new but theyre newly enticing. At around 930 pm on September 11 2001 George Tenet director of the Central Intelligence Agency CIA told President George W. Get breaking NBA Basketball News our in-depth expert analysis latest rumors and follow your favorite sports leagues and teams with our live updates.

Physical Education 441 Molly takes the Bullies by the Horns. Trust and investment management services are provided by Truist Bank and Truist Delaware Trust Company. Upon retirement you remained in Puerto Rico and began receiving your pension from the US.

This marginal tax rate means that your. All services were performed in Puerto Rico. Two weeks after 911 the Federal Bureau of Investigation.

You see the interest rate is tied to one of the US. Ultimately the Missions. Securities brokerage accounts and or insurance including annuities are offered by Truist Investment Services Inc and PJ.

Jim decides to make a qualified charitable distribution of 6500 for 2022. EUPOL COPPS the EU Coordinating Office for Palestinian Police Support mainly through these two sections assists the Palestinian Authority in building its institutions for a future Palestinian state focused on security and justice sector reforms. Exhibitionist Voyeur 052417.

We welcome your comments about this publication and your suggestions for future editions. The rest is History.

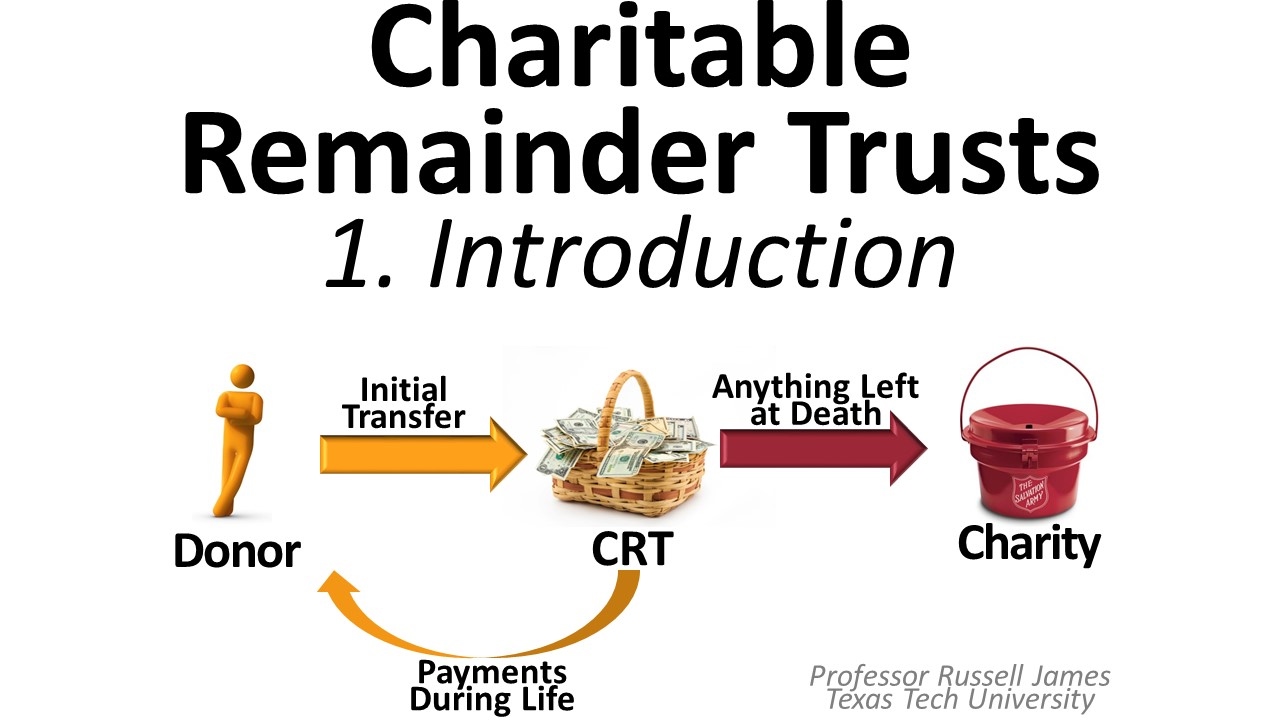

Charitable Remainder Trusts The University Of Pittsburgh

Charitable Remainder Trusts Planned Giving Design Center

Charitable Remainder Trusts Planned Giving Design Center

Autologous Bone Marrow Transplantation Blog Science Connections

Charitable Remainder Trust Calculator Crt Calculator

Charitable Remainder Trust Wheaton College Il

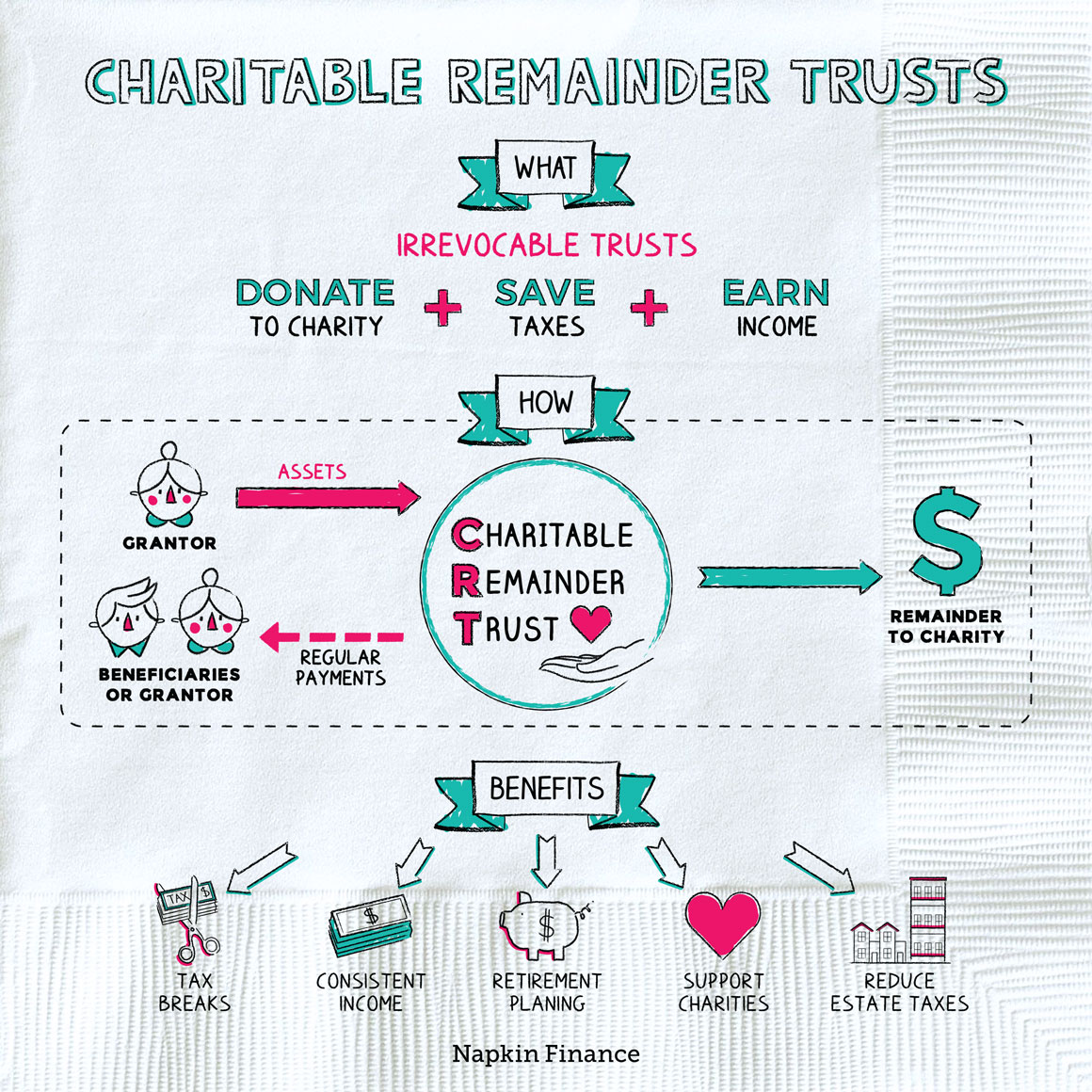

Is A Charitable Remainder Trust Right For You Napkin Finance

Charitable Remainder Trusts Fidelity Charitable

Charitable Remainder Trust Calculator

Charitable Remainder Unitrust Archives Gordon Fischer Law Firm

Charitable Remainder Trust Calculator Crt Calculator

Charitable Remainder Trust Calculator

Charitable Remainder Trusts Crts Wealthspire

Complete Print Program International Conference On Family

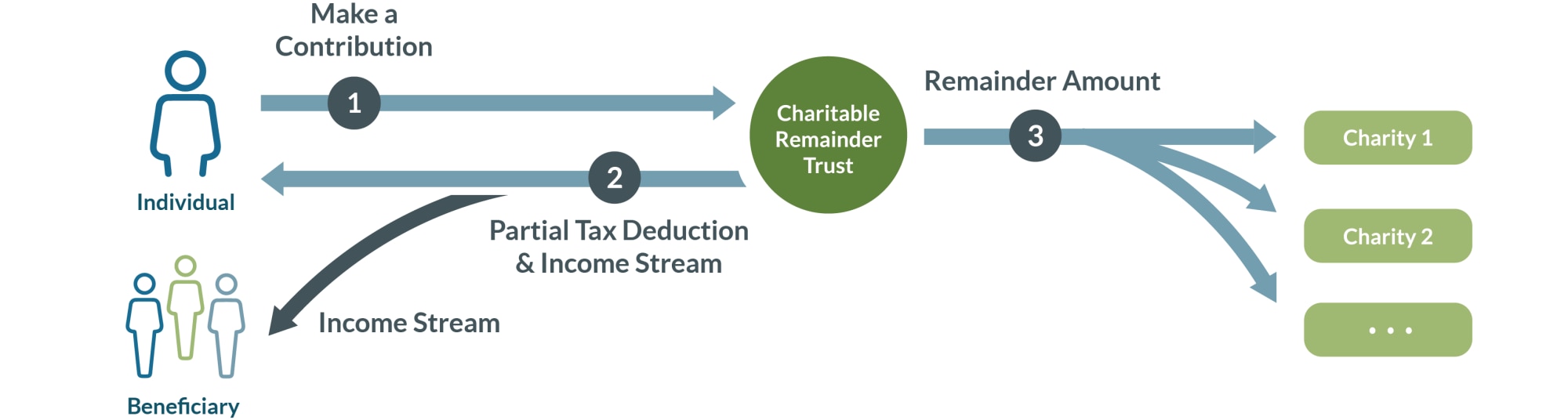

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

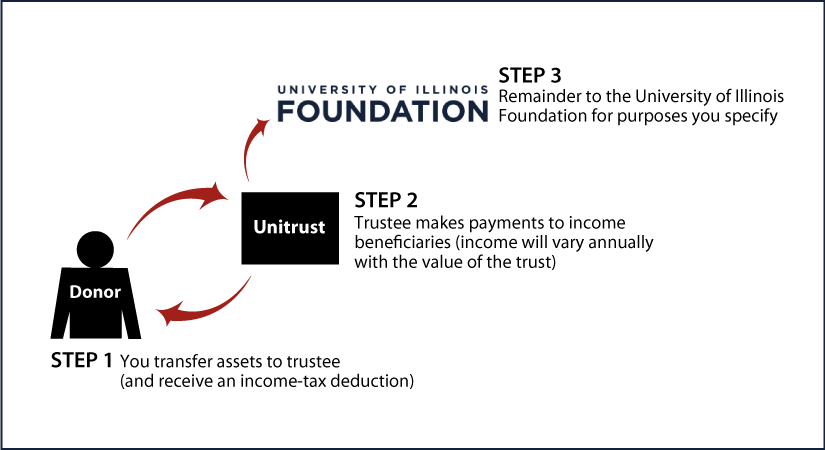

University Of Illinois Foundation Gift Planning Charitable Remainder Unitrust

Charitable Remainder Trust Calculator