Monthly depreciation calculator

Select the currency from the drop-down list optional Enter the. It is fairly simple to use.

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping

Here are the steps for the double declining balance method.

. C is the original purchase price or basis of an asset. Our car depreciation calculator uses the following values source. Next youll divide each years digit by the sum.

Where Di is the depreciation in year i. First of all you have to subtract the. Monthly depreciation Annual.

After a year your cars value decreases to 81 of the initial value. Depreciation Amount Asset Value x Annual Percentage Balance. After two years your cars value.

For example if a cars cost basis is. Whatever Your Investing Goals Are We Have the Tools to Get You Started. The calculator also estimates the first year and the total vehicle depreciation.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Also you can calculate depreciation by following the given steps. 10 Depreciation Calculator Templates 1.

Under the variable declining balance method depreciation rate to be applied to the opening carrying balance of an asset is worked out using the following formula. Multiply the value you get by 2. Depreciation expense is calculated using this formula.

Divide 100 by the number of years in your assets useful life. Cost basis - residual value number of years of the assets expected useful life. Depreciation Rate 2 x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a full 12.

All you need to do is. The first step to figuring out the depreciation rate is to add up all the digits in the number seven. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

Ad Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Let us try another example as follows for a car. In other words the.

D i C R i. Depreciation calculation becomes easy with the ease of depreciated value calculator. 7 6 5 4 3 2 1 28.

The quotient you get is the SLD rate. Annual depreciation Total depreciation Useful lifespan Finally dividing this by 12 will tell you the monthly depreciation for the asset. The MACRS Depreciation Calculator uses the following basic formula.

Line depreciation calculator exactly as you see it. We will even custom tailor the results based upon just a few of. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of.

Monthly depreciation Annual deprecation 12 Monthly depreciation 200 12 1667 Declining balance method As the name states the declining balance method.

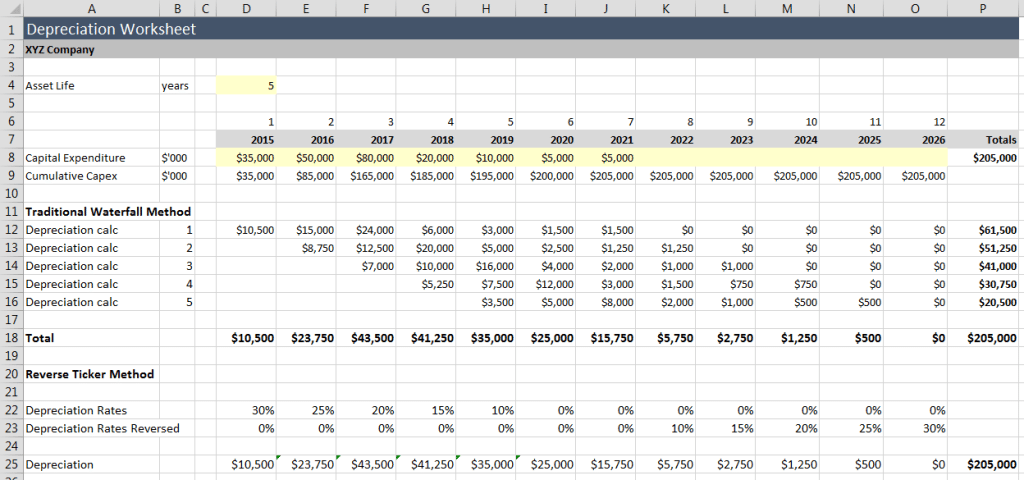

If You Re Not Modelling Depreciation Like This You Re Doing It The Hard Way Access Analytic

Depreciation Formula Examples With Excel Template

Free Depreciation Calculator Online 2 Free Calculations

Depreciation Calculation

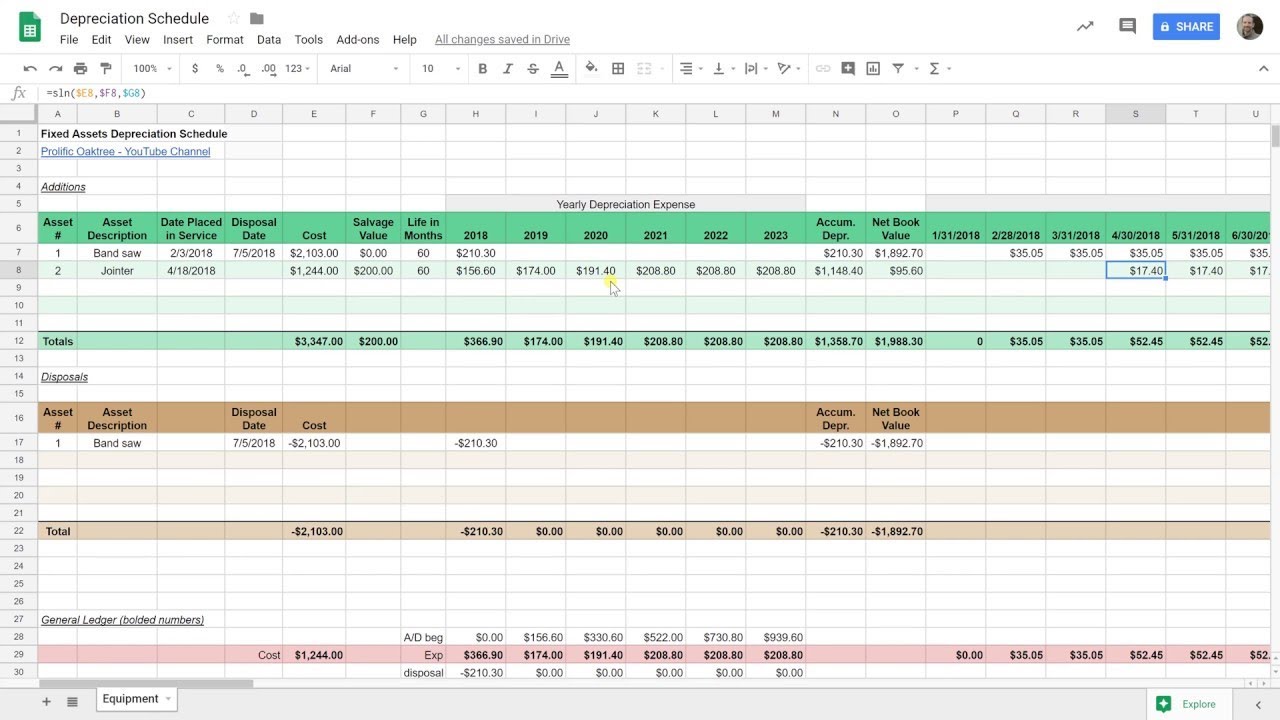

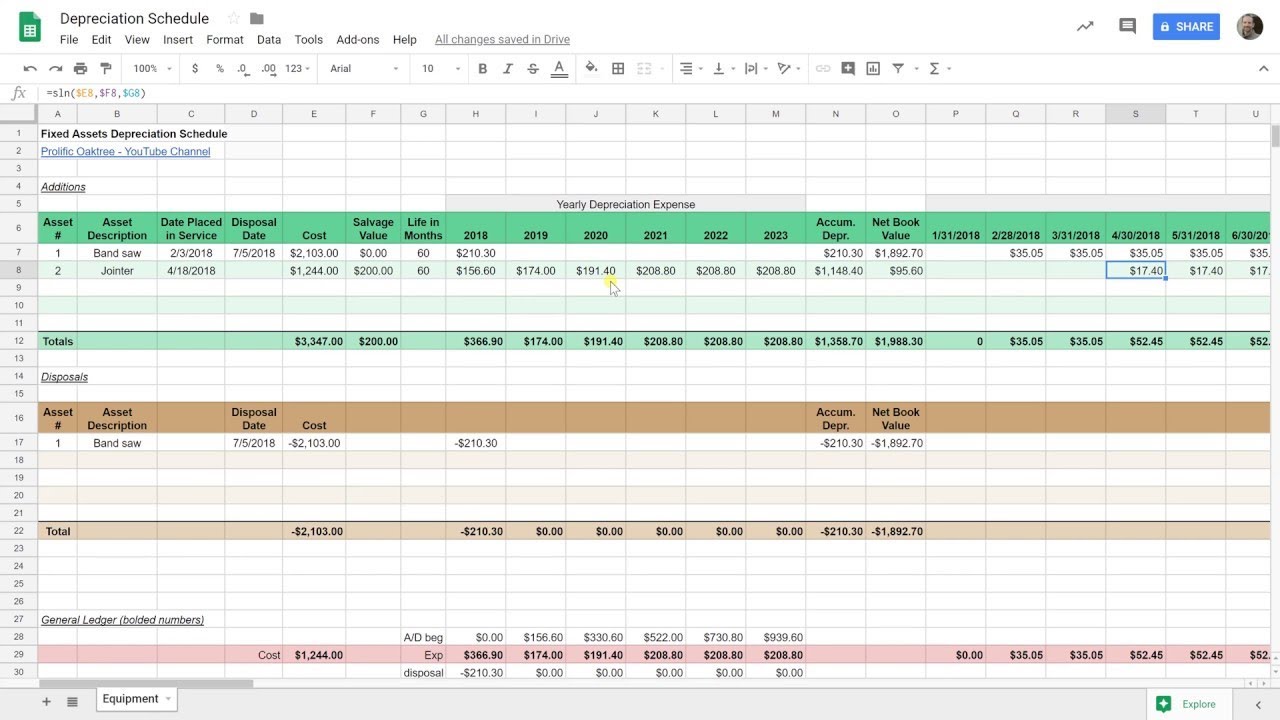

How To Prepare Depreciation Schedule In Excel Youtube

How To Use The Excel Db Function Exceljet

How To Calculate Depreciation Using The Reducing Balance Method In Excel Youtube

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

How To Prepare Depreciation Schedule In Excel Youtube

Straight Line Depreciation Tables Double Entry Bookkeeping

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

How To Use The Excel Amorlinc Function Exceljet

Declining Balance Depreciation Calculator

Depreciation Schedule Template For Straight Line And Declining Balance

Straight Line Depreciation Schedule Calculator Double Entry Bookkeeping

Free Macrs Depreciation Calculator For Excel